Planned Giving

leaving a legacy of faith

Quick Links

Making a Bequest

A bequest is a statement in your will or living trust describing your wishes to make a gift after your death that will support our mission.

Annuities & Unitrusts

Rollovers, Stock & Beneficiary Designation

Rollovers, stock gifts, and beneficiary designation are other planned giving options with a variety of benefits.

Restricted Gifts

St. John’s provides opportunities for parishioners to make special gifts to the church for a specific need, purpose or mission.

Theological Foundation

Stewardship is an expression of gratitude and thankfulness for the blessings of life that come from God. God is love shared and love returned. In practical terms, this means that we individually and collectively make gifts of financial resources and of time and talents to support the mission and ministry of this parish.

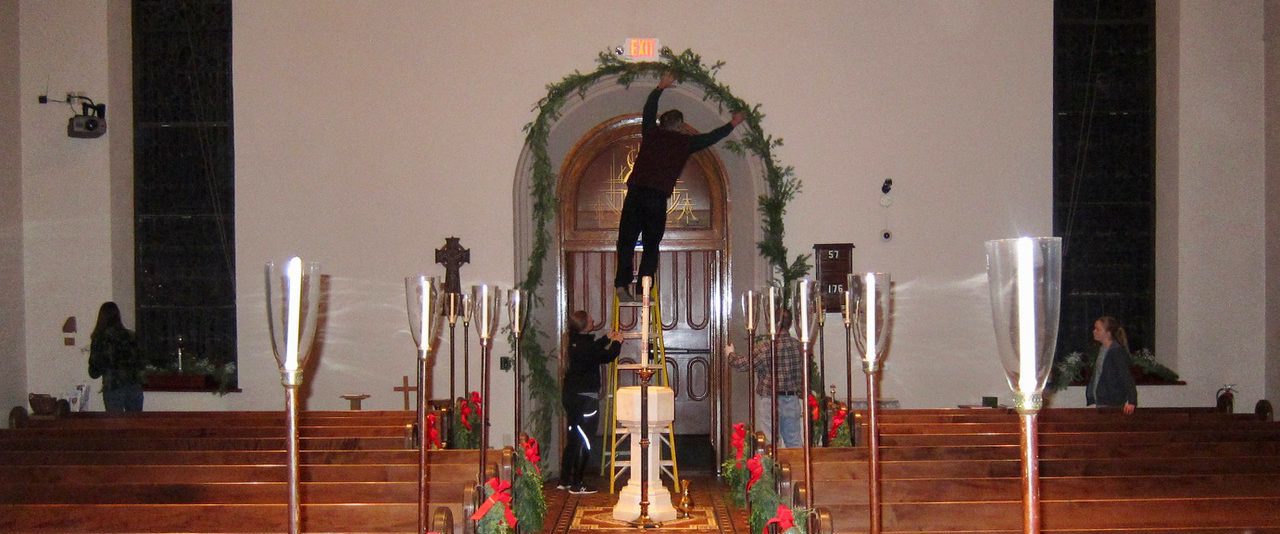

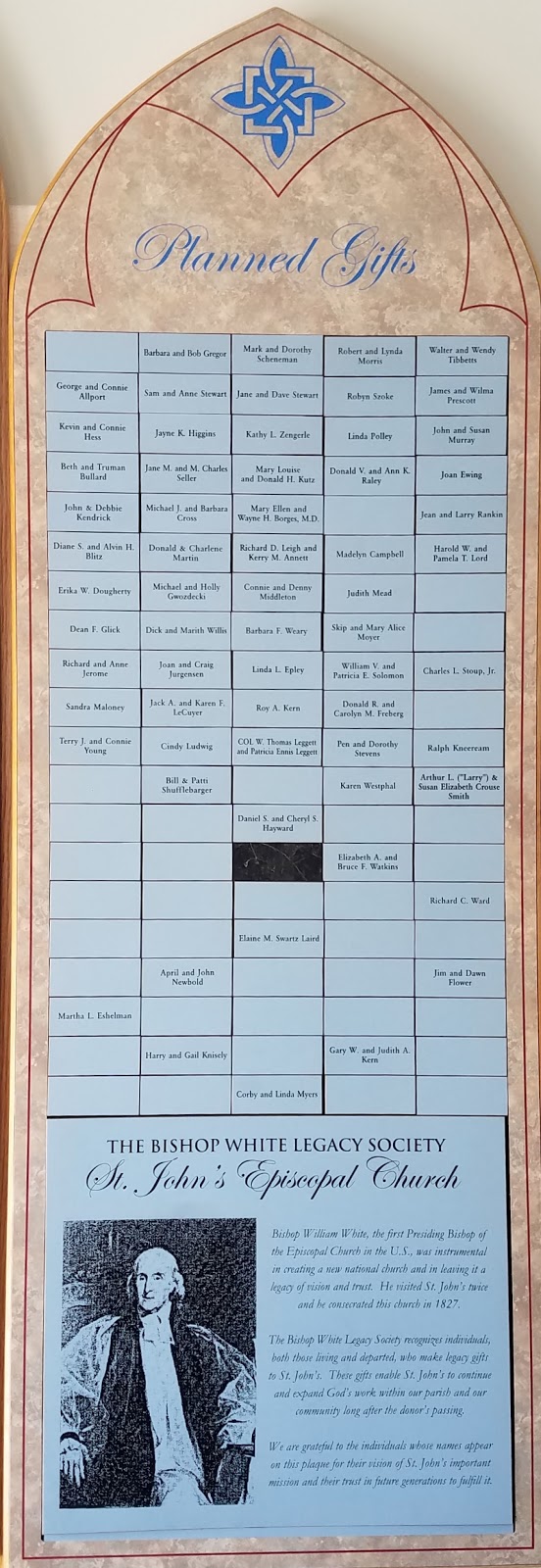

Bishop White Legacy Society

The Bishop White Legacy Society was formed in 2004 to encourage and recognize planned and major gifts to St. John’s. Over the years the group has amassed over 100 members that have shown their desire to contribute to the mission of St. John’s.

A beautiful plaque is located in the cloister of the church with the names of those members present and past. Each year the Society celebrates its heritage by hosting a dinner honoring current members and remembering those who have departed over the past year.

Membership requires only an intention to provide a gift in one’s Will or Trust (or through some other form of planned gift), or a gift of $1,000 or more to the church other than as a stewardship pledge.

Applications for membership are located at the base of the Society’s display or can be found at the St. John’s website. New members receive a complimentary invitation to their inaugural dinner.

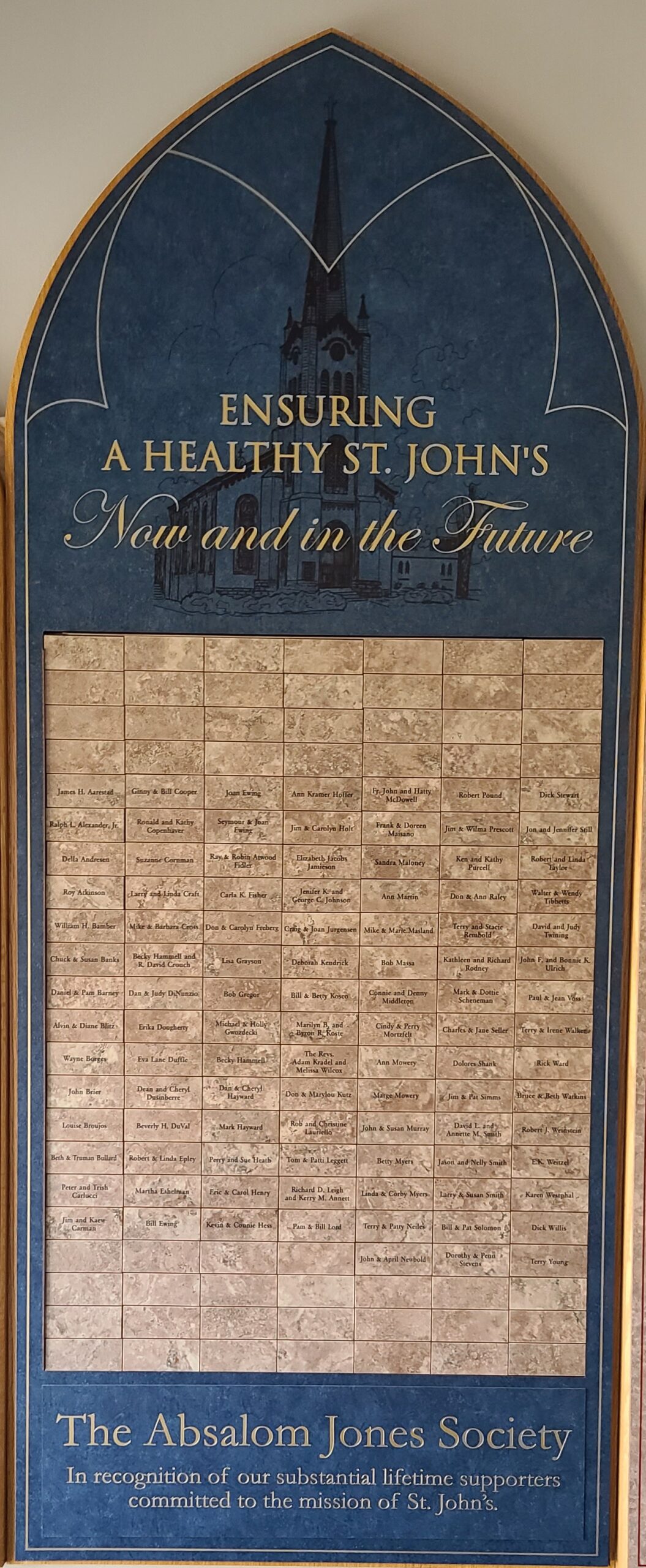

Absalom Jones Legacy Society

Individuals that have made a gift of $1,000 or more to St. John’s other than through their annual stewardship pledge, will be included in the newly formed Absalom Jones Society. A befitting name for a person that made a major impact on racial indifference in our society. A special plaque listing those individuals that are members of this society can be found next to the Bishop White recognition plaque in the cloister of the church.

Absalom Jones was an African-American abolitionist and clergyman who became prominent in Philadelphia, Pennsylvania. Disappointed at the racial discrimination he experienced in a local Methodist church, he founded the Free African Society with Richard Allen in 1787, a mutual aid society for African Americans in the city. The Free African Society included many people newly freed from slavery after the American Revolutionary War.

In 1794 Jones founded the first black Episcopal congregation, and in 1802, he was the first African American to be ordained as a priest in the Episcopal Church of the United States. He is listed on the Episcopal calendar of saints. He is remembered liturgically on the date of his death, February 13, in the 1979 Book of Common Prayer as “Absalom Jones, Priest, 1818”.

Making a Bequest

A bequest is a statement in your will or living trust describing your wishes to make a gift after your death. The most common types of bequests are specific, residuary and contingent.

When including a bequest in your will or living trust, it is recommended you refer to “St. John’s Episcopal Church, Carlisle, PA.” Please also request the St. John’s Tax ID number from the parish office and include it after the address.

There are different kinds of bequest language for the different types:

Specific Bequest – I give the amount of $_________ to St. John’s Episcopal, 1A North Hanover St. Carlisle, PA 17013, to be used for its general purposes.

Residuary Bequest – I give to St. John’s Episcopal, 1A North Hanover St. Carlisle, PA 17013, ___% of the residue of my estate to be used for its general purposes.

Contingent Bequest – In the event _______ predeceases me, I give to St. John’s Episcopal, 1A North Hanover St. Carlisle, PA 17013, (the sum of $_________ , OR the ______% of the residue of my estate) for its general purposes.

Continue reading for others ways you can make planned and immediate gifts to St. John’s.

Charitable Gift Annuities

You may be tired of living at the mercy of the fluctuating stock and real estate markets. A charitable gift annuity is a gift made to our organization that can provide you with a secure source of fixed payments for life and benefit St. John’s as well.

DONOR GIVES STOCK OR CASH

FORMS BASIS OF GIFT ANNUITY

GENERATES REGULAR FIXED PAYMENTS FOR DONOR

REMAINING APPRECIATION PAID TO ST. JOHN’S

Benefits of a charitable gift annuity

- Receive fixed payments to you or another annuitant you designate for life

- Receive a charitable income tax deduction for the charitable gift portion of the annuity

- Benefit from payments that may be partially tax-free

- Further the mission of St. John’s with your gift

How a charitable gift annuity works

A charitable gift annuity is a contract between you and Episcopal Church Foundation (ECF) which issues annuities on St. John’s behalf. ECF receives a 10% administrative fee of the remainder for handling the annuity for St. John’s.

- You transfer cash or property to ECF.

- In exchange, ECF signs an annuity contract and promise to pay fixed payments to you for life. The payment can be quite high depending on your age, and a portion of each payment may even be tax-free.

- You will receive a charitable income tax deduction for the gift portion of the annuity.

- You also receive satisfaction, knowing that you will be helping further St. John’s mission.

The minimum age to start receiving annuity payments is 55. However, you can establish a charitable gift annuity at a younger age and defer the start of annuity payments to age 55. The minimum amount to establish a charitable gift annuity at ECF is $5,000.

More information

For a personal illustration of your charitable gift annuity or if you have any questions about charitable gift annuities, please contact our Treasurer, Alvin Blitz. He would be happy to assist you and answer your questions.

For a list of the current rates for one and two life annuities based on age, please consult this rate summary from the American Council on Gift Annuities.

Charitable Remainder Unitrusts

You may be concerned about the high cost of capital gains tax with the sale of an appreciated asset. Perhaps you recently sold property and are looking for a way to save on taxes this year and plan for retirement. A charitable remainder unitrust might offer the solutions you need.

DONOR TRANSFERS STOCK, CASH, OTHER ASSETS

ASSETS FUND UNITRUST (TAX FREE)

DONOR RECEIVES UNITRUST PAYOUTS

REMAINING UNITRUST VALUE PAID TO ST. JOHN’S

Benefits of a charitable remainder unitrust

- Receive income for life, for a term of up to 20 years or life plus a term of up to 20 years

- Avoid capital gains on the sale of your appreciated assets

- Receive an immediate charitable income tax deduction for the charitable portion of the trust

- Establish a future legacy gift to St. John’s

How a charitable remainder unitrust works

- You transfer cash or assets to fund a charitable remainder unitrust.

- In the case of a trust funded with appreciated assets, the trust will then sell the assets tax-free.

- The trust is invested to pay income to you or any other trust beneficiaries you select based on a life, lives, a term of up to 20 years or a life plus a term of up to 20 years.

- You receive an income tax deduction in the year you transfer assets to the trust.

- St. John’s benefits from what remains in the trust after all the trust payments have been made.

More information

If you have any questions about a charitable remainder unitrust, please contact Alvin Blitz. Alvin can provide you with a personalized illustration of how a charitable remainder unitrust can benefit you and your family.

A charitable remainder unitrust pays you income that reflects the value of the trust’s assets. Your income has the potential to increase over time as the trust grows in value.

There are several unitrust payout options to meet your needs. The best payout option may depend on the nature of the asset used to fund the trust. We would be happy to work with you and your tax advisor to determine which payout option is best for you.

IRA Charitable Rollover or Qualified Charitable Distribution

You may be looking for a way to make a big difference to help further our mission.

If you are 70½ or older, a qualified charitable distribution (QCD), also known as an IRA charitable rollover, is a way you can help continue our work and benefit St. John’s this very year.

In a QDC, the donor directs their IRA custodian to make a gift of a portion of the IRA’s value to St. John’s.

PORTION OF IRA VALUE

IMMEDIATE GIFT TO ST. JOHN’S

Benefits of a QCD

- Avoid taxes on transfers of up to $100,000 each year from your IRA to any qualified charity, including St. John’s

- Make a gift that is not subject to the deduction limits on charitable gifts

- Turning your Required Minimum Distribution (RMD) into a QCD will reduce your taxable income

- Help further the work and mission of St. John’s

How a QCD gift works

- Contact your IRA plan administrator to make a gift from your IRA to St. John’s.

- Your IRA funds will be directly transferred to our organization to help continue our important work.

- Please note that QCD gifts do not qualify for a charitable deduction.

- Please contact Fr. Adam or Alvin Blitz if you wish for your gift to be used for a specific purpose.

More information

If you have any questions about a QCD, please contact Alvin Blitz. Alvin will be happy to assist you in working through the mechanics of making a QCD to St. John’s and further explaining the benefits of using a QCD rather than a cash gift to save on taxes.

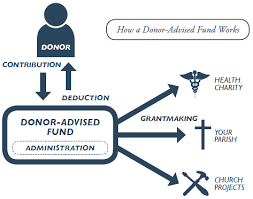

Donor-Advised Funds

Donor-Advised Funds (DAF) are one of the fastest growing vehicles for individual philanthropy or charitable giving.

What is a Donor-Advised Fund?

A donor-advised fund, or DAF, is a philanthropic vehicle established as a public charity. It allows donors to establish their own individual fund, make charitable contributions to that fund, and receive an immediate tax benefit for that contribution. The donor then recommends grants from the fund to qualified charities.

Specifically the IRS states it this way:

The IRS Definition — IRC 4966(d)(2) defines a “donor-advised fund” as (1) a fund or account owned and controlled by a sponsoring organization, (2) which is separately identified by reference to contributions of the donor or donors, and (3)where the donor (or a person appointed or designated by the donor) has or reasonably expects to have advisory privileges over the distribution or investments of the assets. All three prongs of the definition must be met in order for a fund or account to be treated as a donor-advised fund.

Why give via a Donor-Advised Fund?

- Allows you to create a fund to support over time your favorite charities – Donor advised funds are one way of setting up a philanthropy fund that will allow you to contribute to non-profit/charitable organizations which you like to support.

- Immediate tax benefits and payout flexibility – The donor advised fund allows you to take a charitable deduction in a strong market climate and disperse the funds over a period of time.

- Donating securities in kind can minimize your tax burden and maximize your donation – After setting up your fund and moving designated stocks/securities into it, that money will be invested by the fund holder and will continue to grow.

How does this work?

- You select an administrator for the fund. This can be a bank, an investment firm or even a specific charity. The examples given here are from the Episcopal Church Fund (ECF).

- ECF allows anyone, even non-Episcopalians, to create a fund.

- Most entities require a minimum contribution to set up a DAF. ECF requires a minimum of $2500 to set up the fund and it requires that 51% of grants over a 5-year period be made to Episcopal churches, dioceses, camps, seminaries or other Episcopal organizations.

- ECF donors may make as many grants as they wish for $100 or more.

- ECF donors have 24/7 access to the donor portal for making requests.

- ECF donors have several investment options that they can elect for their DAF.

- Grants may be made to any qualified charity.

What are the downsides?

- The sponsoring organization does have the final right of approval for grant requests, so it is important to make sure that you have a conversation with the administrator to discuss how you want to have your wishes met. Typically most requests for grants are honored.

- Grants cannot be made to individuals. They can only be made to designated charities.

- Grants CANNOT be made to fulfill an annual pledge or pledge to a special project or capital campaign. However, donors can let their intentions for making an annual/quarterly or monthly grant or grants known to their church.

- You CANNOT use your grants for anything that would provide value to you or others (e.g. tickets to the Boar’s Head Festival or attendance at a gala event for another charity you support).

If you would like to learn more about Donor Advised Funds, the Episcopal Church Foundation has a couple of webinars and accompanying powerpoint slides that might be helpful for you. Please check these links: https://www.ecfvp.org/uploads/webinars/files/DAF_slides.pdf and https://www.ecfvp.org/uploads/webinars/files/DAF_Donor.pdf.

Please feel free to reach out to Alvin Blitz or Becky Hammell for further information.

Stock, Mutual Fund, and Exchange-Traded Fund Gifts

Donating appreciated securities, including stocks, mutual funds and exchange-traded funds (ETFs) is an easy and tax-effective way for you to make a gift to St. John’s.

DONOR’S STOCK, MUTUAL FUNDS, OR ETFS

IMMEDIATE GIFT TO ST. JOHN’S

Benefits of gifts of stocks, mutual funds or ETFs

- Avoid paying capital gains tax on the sale of appreciated stock, mutual fund or ETF

- Receive a charitable income tax deduction

- Further the mission of St. John’s

- Great way to pay for your stewardship and capital campaign pledge

How to make a gift of stocks, mutual funds or ETFs

St. John’s has a special brokerage account with Charles Schwab for the electronic transfer of any stocks, bonds, mutual funds or ETFs. Please contact Alvin Blitz for the specific instructions for your broker or financial advisor to transfer such shares to this account.

More information

If you have any questions about gifts of stocks, mutual funds or ETFs, please contact Alvin Blitz.

There are special rules for valuing a gift of stock. The value of a charitable gift of stock or ETF is determined by taking the mean between the high and low stock or ETF price on the date of the gift. Mutual fund shares are valued using the closing price for the fund on the date of the gift.

Only stocks, mutual funds or ETFs that have been held for more than one year qualify for avoidance of capital gain tax so make sure you are aware of how long you held the stock, mutual fund or ETF before giving it to St. John’s.

Beneficiary Designation Gifts (IRAs, Life Insurance, Savings and Brokerage Accounts)

A beneficiary designation gift is a simple and affordable way to make a gift to support St. John’s. You simply designate the church as a beneficiary of your retirement, investment or bank account, or life insurance policy.

DONOR REQUESTS DESIGNATION FORM FROM CUSTODIAN

ST. JOHN’S DESIGNATED AS BENEFICIARY

DONOR CONTINUES USING ACCOUNT IN LIFE

ST. JOHN’S RECEIVES ASSETS AT DEATH

Benefits of a beneficiary designation gift

- Support the causes that you care about

- Continue to use your account as long as you need to

- Simplify your planning and avoid expensive legal fees

- Reduce the burden of taxes on your family

- Receive an estate and PA inheritance tax charitable deduction

How a beneficiary designation gift works

- To make your gift, contact the person who helps you with your account or insurance policy, such as your broker, banker or insurance agent.

- Ask them to send you a new beneficiary designation form.

- Complete the form, sign it and mail it back to your broker, banker or agent.

- When you pass away, your account or insurance policy will be paid or transferred to St. John’s, consistent with the beneficiary designation.

Important considerations for your future

If you are interested in making a gift but are also concerned about your future needs, keep in mind that beneficiary designation gifts are among the most flexible of all charitable gifts. Even after you complete the beneficiary designation form, you can take distributions or withdrawals from your retirement, investment or bank account and continue to freely use your account.

You can also change your mind at any time in the future for any reason, including if you have a loved one who needs your financial help.

More information

If you have any questions about leaving a beneficiary designation gift to St. John’s, please contact Fr. Adam or Alvin Blitz. We would be happy to assist you.

If you have already designated us as a beneficiary of an asset or as part of your estate plan, please let us know. We would like to ask you join our Bishop White Society to recognize you and your family for your commitment to St. John’s.

Flexibility – Most beneficiary designation forms are very flexible. You can name St. John’s as a “full” or “partial” beneficiary of your account or life insurance policy. You can also name St. John’s as a “primary” or “contingent” beneficiary.

Family Considerations – Beneficiary designation gifts allow you to provide for family and support the causes that matter most to you.

With a designation form you could, for example, name your spouse as the “primary” beneficiary and each of your children and St. John’s as “partial contingent” beneficiaries. With this arrangement, if your spouse survives you, he or she would receive the account. If not, the account or policy would be paid out to your children and St. John’s in whatever shares (or percentages) you chose on the designation form.

Terminology – Beneficiary designation gifts are simple and straightforward. Common terminology includes “beneficiary designation” but also includes “payable on death” or “transfer on death.” The term “beneficiary designation” is most commonly used when naming beneficiaries of retirement plans or life insurance policies. The term payable on death (or “POD”) typically involves the designation of a beneficiary of a checking account, savings account or certificates of deposit, and transfer on death (or “TOD”) often involves the designation of a beneficiary of stocks, bonds or mutual funds.

Restricted Gifts

St. John’s provides opportunities for its parishioners to make special gifts to the church for a specific need, purpose or mission. These special opportunities are usually listed on our “wish list” for current needs or the vestry may prioritize a long-term need for the mission of the church.

At present the current “wish list” is available from Fr. Adam. In addition, the Vestry has considered the long-term funding for a full-time Associate to be its greatest need at this time.

Individuals interested in supporting this goal may consider making gifts above and beyond their annual pledge to the “Associate Fund” or to the “Staff Fund.” The former account is restricted to underwriting just the Associate and the latter fund is available to underwrite the cost of the entire staff. Gifts can be made by cash, appreciated stock, mutual funds, ETFs, QCDs, and even real estate under certain circumstances.

Planned gifts such as bequests, charitable gift annuities and charitable remainder unitrusts can be used to fund a restricted gift. If an individual desires to make a restricted gift for a specific purpose through the consolidated fund of the church, the minimum for such gift is $50,000, and the purpose of the fund must be approved by the Vestry of the church.

Presently the Vestry has approximately 15 named funds for specific purposes which are called “dedicated-use” funds, since the fund is dedicated for the purpose intended with the proviso that it may be used for other purposes, with a two-thirds vote of the Vestry. This is generally the case when the purpose for which the fund was established is no longer feasible.

Contributions can be added to an existing fund in any amount.

Because of the complexity of such gifts and the long-term impact they have on the future mission of the church, it is highly recommended that any individuals interested in establishing a dedicated-use fund contact Fr. Adam or Alvin Blitz to discuss the feasibility of such fund.